PPAs could be the missing link to a reliable and renewable future

How can we ensure that future electricity markets attract enough investment, protect consumers from price spikes and provide the right incentives for flexibility?

Energy systems based on renewables face a triple challenge: ensuring the bankability of projects under uncertainty and providing adequate signals for flexibility, all the while protecting consumers from extreme prices. Having power purchase agreements (PPAs) in parallel with the power exchange can contribute to all three.

PPAs are bilateral contracts between a seller and a buyer of energy. These agreements set a fixed price for which a set quantity of energy can be traded over the duration of the contract. PPAs have traditionally been used to secure the bankability of energy projects, which means shielding the energy producer from energy price variations and making the project more attractive to financers such as banks or shareholders.

Taking price variation away completely, however, can mean actors have no incentives to act flexibly by consuming less and producing more when prices are high, for example. The key to resolve this impasse lies in how we design the PPAs. Imagine consumers face a fixed price for the amount of energy they consume within the limits of the contract, but receive a bonus equal to the real-time price when they consume less. In this case, the consumers will not have to pay extremely high prices to consume the energy they have bought through a PPA, but will still have an incentive to consume less when real-time prices are high and more when they are low.

Producers, in turn, are paid a fixed price for all the units sold through the PPA, but have to buy energy if they are not able to produce all the units they have sold. This way, producers are still shielded from very low prices, but have an incentive to produce more when prices are high and less when they are low.

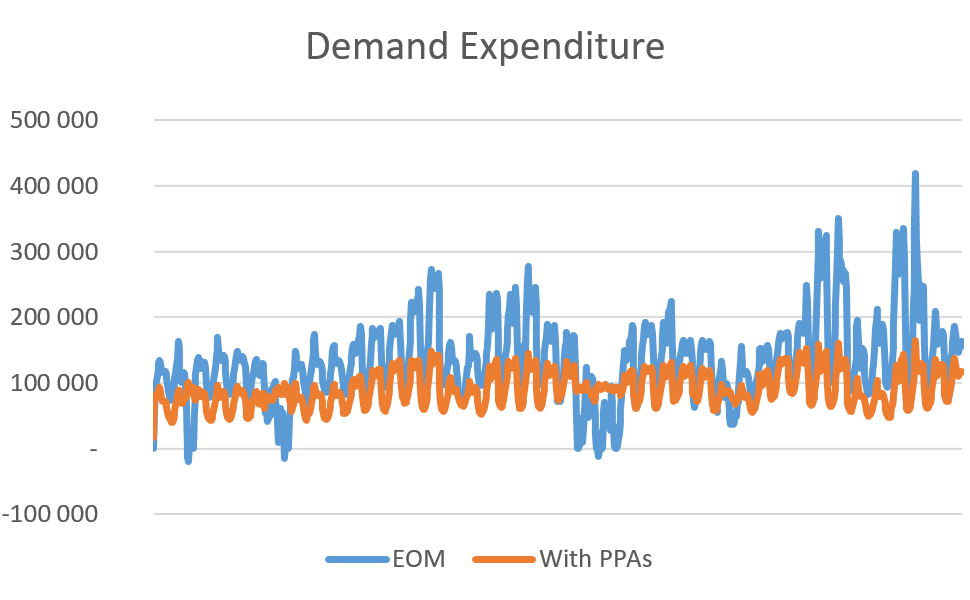

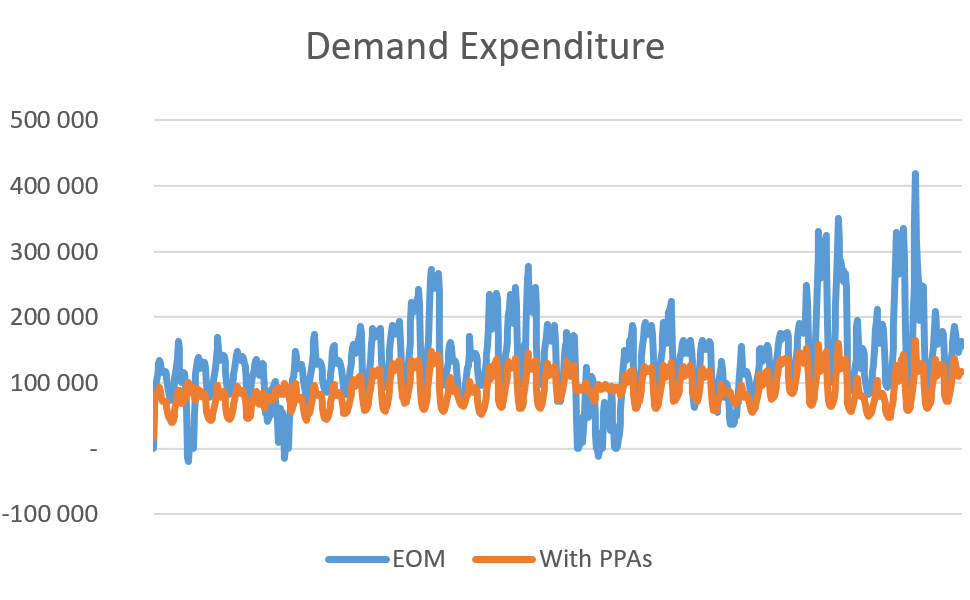

Our simulations show that PPAs designed in this way, while keeping incentives for flexibility, are still effective in protecting consumers from extreme prices. The graph shows actual expenditure without PPAs in the West of Denmark and simulated expenditure under the agreements. Note that the peaks in expenditure are much lower under PPAs, although the mean expenditure remains constant.

Our results suggest that combining PPAs designed as we describe here with existing energy-only markets can be a powerful tool to ensure a reliable and renewable future. The Nordics, with a strong power exchange and ambitious renewables targets, are the perfect candidates to lead the way.

Feedback – comments? Get in touch with Felipe Fausto from DTU Management.